Mortgage, Saving, Science & Home Ownership

The Key To Your Success

Hi Money Masters!

Goal. Target. Objective. Intention. There are many words to identify specific wants or ambitions we have in our lives. We set goals to improve our quality of life.

What is a goal? The word “goal” is defined as an aim or desired result; a plan, a purpose.

Setting Goals

Goal setting is an important method of deciding what you want to achieve in your life. Goals help you separate what is important from what is irrelevant or just a distraction. They give you direction and keep you focused on your destination.

Goals can be applied to any aspect of life; our health, our careers, our relationships. As we go through the year, let’s focus on financial goals. Most people work hard, but they don’t seem to get anywhere worthwhile when it comes to finances. Making money and spending it can feel like an endless cycle. Setting goals will keep you organized and add structure and strategy to your financial plan.

Financial Goals

There are several steps to setting your financial goals:

1. Evaluate: take some time to think about and write down your current financial situation. Ask yourself a couple of questions. Are you happy with your current financial situation? Do you need to expand your 2018 goals or do you need to start from scratch? Are you currently doing a good job with managing your money? Are you directing your money or is it directing you?

2. Define: write down specific goals. What do you want your money to do for you in the future? Ask yourself, what is it that you want to accomplish this year financially?

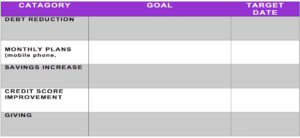

Make S.M.A.R.T goals (Specific, Measurable, Attainable, Realistic and Time-sensitive). Write down the 2018-19 goals you want to accomplish in the table below.

Please Note: It is critical that your goals focus on something positive. This means focus your goals on what you want versus what you don’t want.

Examples of positive goals:

-

I will improve my Credit Score to 750 by December 31, 2018.

-

I will pay off one debt by November 2018.

-

I will save an additional $3000.00 by January 2019.

-

My credit card balances will be no more than 25% of the limits by September 2018.

Example of a negative, unclear goal: I do not want to be in any debt by the end of the year.

We will keep it simple by just focusing on 5 specific financial goals. Use the table below to assist you.

3. Be Committed: Remember, you rarely get what you want in life. You only get what you are absolutely committed to creating.

4. Be accountable: tell someone else about your goals and have them follow up with you!

2 Comments

Christine Wheeler

In The above example for the positive goals, I am actually using that as a template. Thank you for sending that.

Susie

You’re right about keeping the house cool with the shade down. I appreciate your articles. Thank you!!!